Meet Our Investment Strategy & Risk Management Team

Our dedicated Investment Strategy & Risk Management Team is responsible for the analytics, risk management, and methodology that guide Adams Street Partners’ portfolio construction.

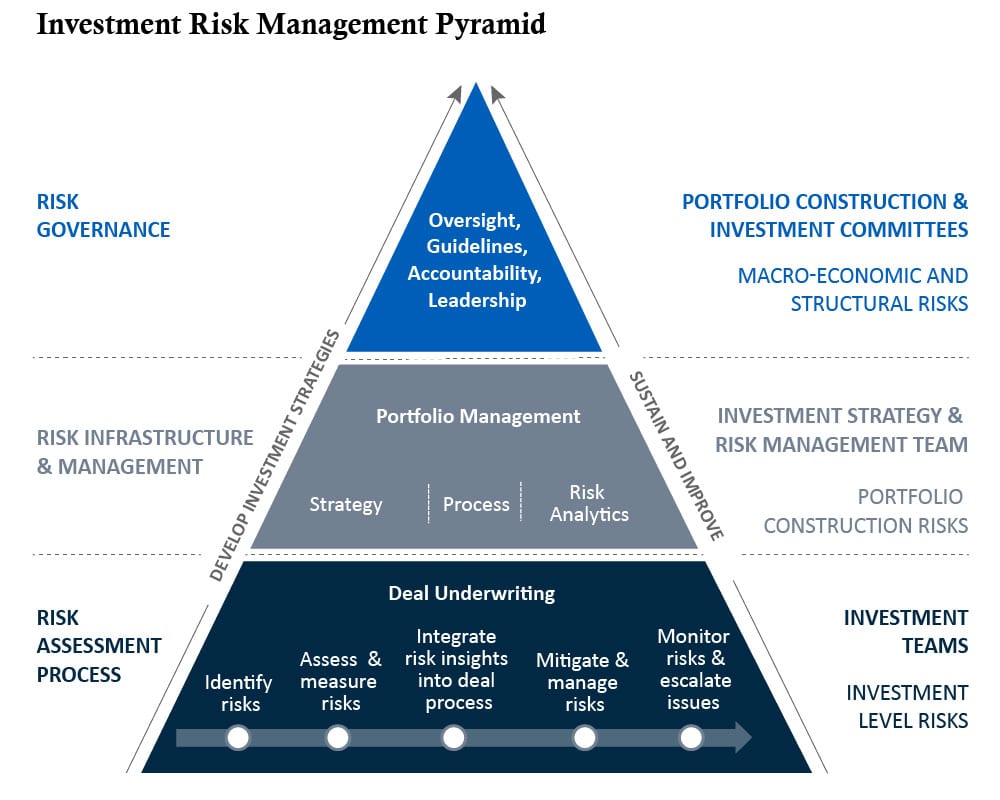

We believe investing in the private markets while protecting investment capital requires a structured and cohesive risk management process that concurrently applies both a top-down (discipline in portfolio construction) and bottom-up (selectivity in investments made) approach. Adams Street does not necessarily strive to be a low-risk investor but instead aims to maximize results relative to the level of risk undertaken.

Adams Street’s robust risk management framework ties closely to the firm’s top-down / bottom-up approach to portfolio construction, which we believe is key.

Investment Strategy, Risk Management, and Performance Reporting Professionals

Years of Combined Experience

Years of Proprietary Data and Analytics

Adams Street views investment risk as “the uncertainty of achieving expected returns or expected cash flow over the life of a portfolio”. Investment risk is influenced by a variety of risk factors that are assessed and monitored across three buckets:

By grouping risk factors into these distinct buckets, our framework is aligned with, and managed alongside of, the portfolio construction process to achieve our goal of a risk/return balance.

Investment risk is governed via Adams Street’s Portfolio Construction Committee, managed from a top-down perspective by the Investment Strategy & Risk Management Team, and incorporated into bottom-up investment decision making by the respective investment team. This structure creates a cohesive process where each risk bucket is assessed and managed by the applicable team and elevated to the Portfolio Construction Committee as appropriate.

Adams Street Partners maintains various risk management controls that are intended to address risks that include business and operational risks, legal and regulatory risks, and reputational risks. These risk management controls are reflected in the policies and procedures of relevant teams within Adams Street Partners, including:

Responsible for the analytics, risk management, and methodology that guide Adams Street Partners’ portfolio construction.

Responsible for gathering, interpreting, analyzing, delivering, and communicating investment performance information in a timely and efficient manner while ensuring high data integrity.

Continuous communication and collaboration within the investment teams to assess risk in connection with their investment decisions and ongoing monitoring of investments.

Responsible for addressing the legal and regulatory risks that face Adams Street Partners’ business.

Responsible for investment accounting, valuations, cash management, and capital calls and distributions, and is expected to ensure the accuracy and timeliness of these operations.

Responsible for the effective operation and security of the information technology tools on which Adams Street Partners’ business relies.

At Adams Street, Operational Due Diligence (“ODD”) is integrated into the investment due diligence performed by each of the investment teams. The ODD personnel and process is independent of the investment teams and is performed in parallel with the investment due diligence. This independent review process assesses operational risks and validates controls in place that can mitigate a weak operational environment.

Included in our ODD process are the following:

Following an investment, the ODD professionals perform risk-based post-investment monitoring which includes surveys, phone calls, and onsite follow-up meetings to ensure the operational environment remains robust.

Our dedicated Investment Strategy & Risk Management Team is responsible for the analytics, risk management, and methodology that guide Adams Street Partners’ portfolio construction.