This site and the materials herein are directed only to financial advisors or other investment professionals and are not intended to be shown to the general public.

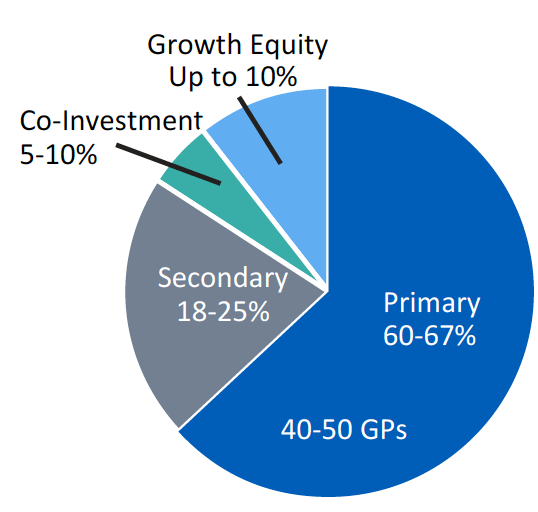

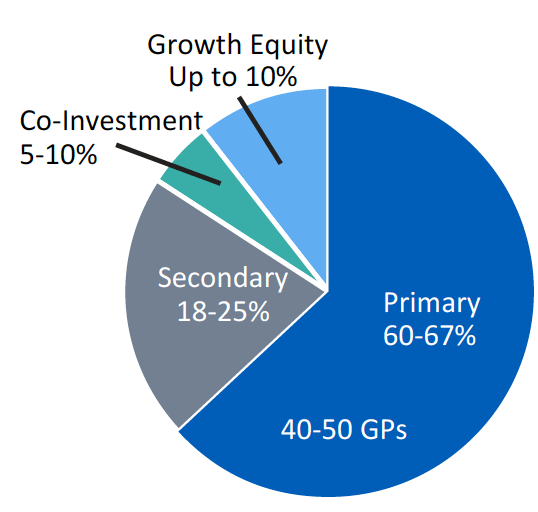

At Adams Street, our investment strategies work with each other to make sure we build customized, diverse portfolios. Whether we’re investing invest in a large fund or need a series of targeted investors, we work as one to provide actionable insights that translate to real-world action.

Our relationships and decades of analysis are shared across global teams and strategies, providing a structural advantage to access high-quality deal flow, risk management strategies, and investment opportunities that others miss.

We have strong alignment with GPs and we offer flexible, out-of-the box capital solutions. Our dedicated and responsive co-investment team evaluates and makes investment decisions independent of the firm’s other investment teams.

We focus on proactively identifying and purchasing minority equity stakes in market-leading technology and healthcare companies. We look to limit downside risk and work to create value that will produce market leading returns.

Donec urna sem, placerat tincidunt molestie sit amet, fringilla vitae ligula. Quisque rhoncus placerat lorem. Curabitur et diam at risus iaculis rhoncus suscipit eu sapien.

Donec urna sem, placerat tincidunt molestie sit amet, fringilla vitae ligula. Quisque rhoncus placerat lorem. Curabitur et diam at risus iaculis rhoncus suscipit eu sapien.

This is a real quick intro sentence to support the header.

Donec urna sem, placerat tincidunt molestie sit amet, fringilla vitae ligula. Quisque rhoncus placerat lorem. Curabitur et diam at risus iaculis rhoncus suscipit eu sapien.

Donec urna sem, placerat tincidunt molestie sit amet, fringilla vitae ligula. Quisque rhoncus placerat lorem. Curabitur et diam at risus iaculis rhoncus suscipit eu sapien.

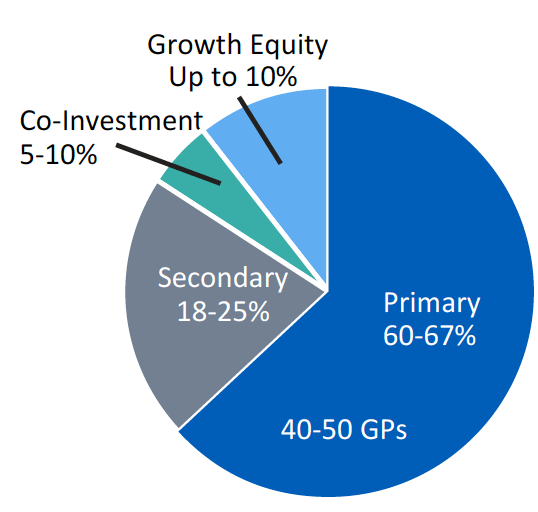

At Adams Street, our investment strategies work with each other to make sure we build customized, diverse portfolios. Whether we’re investing invest in a large fund or need a series of targeted investors, we work as one to provide actionable insights that translate to real-world action.

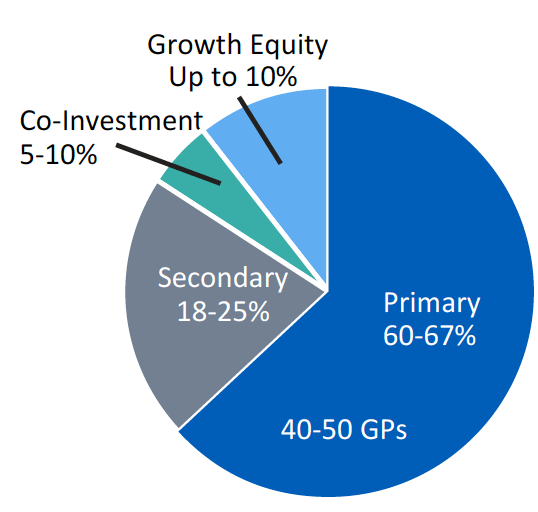

Our relationships and decades of analysis are shared across global teams and strategies, providing a structural advantage to access high-quality deal flow, risk management strategies, and investment opportunities that others miss.

Our General Partners trust us to recognize the right opportunity and work with them for value creation and market-leading returns. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

We can find the opportunities because our teams have the opportunities. Communicating across platforms, including our Primary and Secondary investment teams, we target the right GPs.

We have the research and analytical capability to invest across markets, across businesses, and across platforms. We don’t let good opportunities pass us by.

Intro style paragraph text via the WYSIWGY. The header above is an H2 but could also be an H3 or an H5 or the smaller, all caps H6 seen elsewhere.

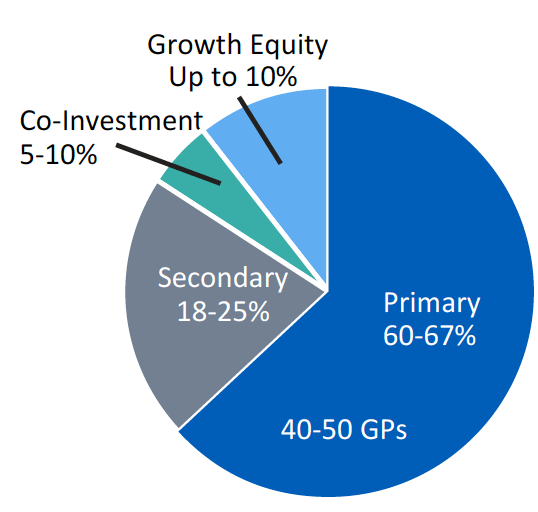

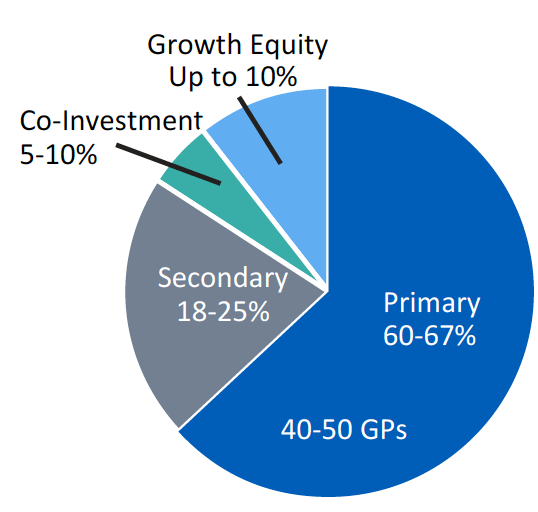

We are disciplined in our decisionmaking, carefully considering both company-specific risk/return dynamics and how each investment fits from an overall portfolio construction perspective.

We only invest in deals that are backed by strong General Partner sponsors. We assess each deal’s risks and opportunities, then combine these with our views on entry and exit valuation to determine the most attractive investment.

We operate as part of a global platform, leveraging the relationships, knowledge, and experience of our staff in every stage of the investment process in order to better source and diligence investment opportunities.

Our General Partners trust us to recognize the right opportunity and work with them for value creation and market-leading returns. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

We can find the opportunities because our teams have the opportunities. Communicating across platforms, including our Primary and Secondary investment teams, we target the right GPs.

We have the research and analytical capability to invest across markets, across businesses, and across platforms. We don’t let good opportunities pass us by.

Co-investment is a key part of Adams Street offerings. We have the mandate to invest in smart, targeted, and aggressive ways, and can invest tens of millions of dollars to close a deal.

Foresight from Adams Street empowers our sophisticated investors with on-demand access to custom analysis of their private markets investment portfolio.

Foresight provides unique Insight, Access, and Flexibility to private market investments, improving performance evaluation and enhancing decision-making ability.

Since 1972, Adams Street has solely focused on private markets investment management. Over the past five decades, we’ve grown from a single office in Chicago to 12 locations around the world, with investments across more than 30 nations. Our history of pioneering breakthrough investment strategies gives us the credibility and confidence to develop new solutions that are relevant to different audiences in evolving markets.

Propelled by our expertise, relationships, technology, and insights, Adams Street Partners strives to chart the path forward for the private markets and our clients.

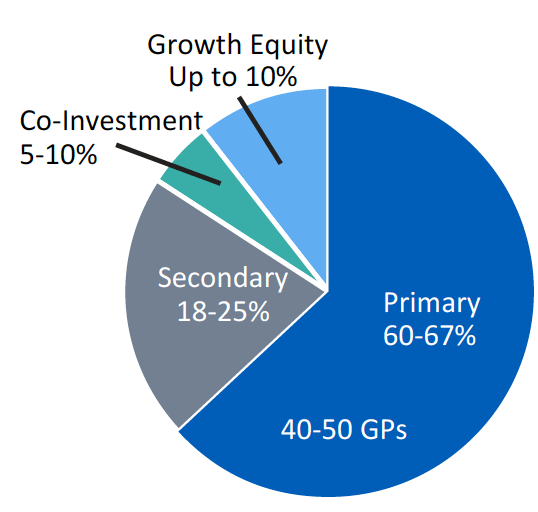

At Adams Street, our investment strategies work with each other to make sure we build customized, diverse portfolios. Whether we’re investing invest in a large fund or need a series of targeted investors, we work as one to provide actionable insights that translate to real-world action.

Our relationships and decades of analysis are shared across global teams and strategies, providing a structural advantage to access high-quality deal flow, risk management strategies, and investment opportunities that others miss.

We have strong alignment with GPs and we offer flexible, out-of-the box capital solutions. Our dedicated and responsive co-investment team evaluates and makes investment decisions independent of the firm’s other investment teams.

We focus on proactively identifying and purchasing minority equity stakes in market-leading technology and healthcare companies. We look to limit downside risk and work to create value that will produce market leading returns.

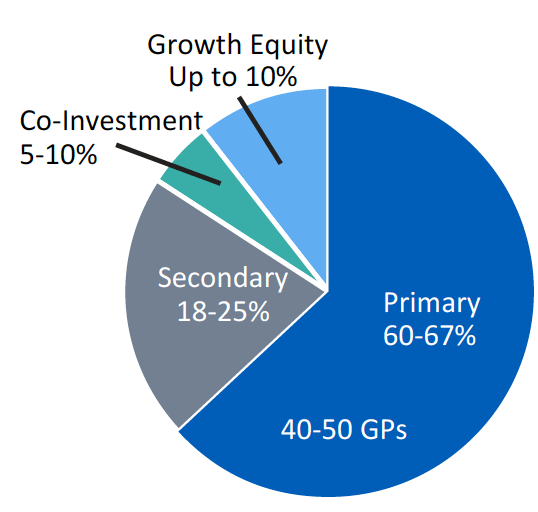

We have access to, and partner with, the industry’s top-tier private equity fund managers who can repeatedly identify, invest in, and add value to potential market-leading companies that produce market-leading returns.

We enjoy a significant deal sourcing advantage due to our extensive relationships in the private equity community. This not only positions us to see a large portion of the overall deals offered in the market but enables us to be highly selective in choosing the most exceptional investments.

As a trusted investor in premier General Partners across the globe, we are an attractive substitute limited partner and are introduced to invitation-only opportunities.