This site and the materials herein are directed only to financial advisors or other investment professionals and are not intended to be shown to the general public.

The European venture ecosystem has hit an inflection point and is now widely recognized as being a major contributor to the global venture market. In Europe, the ecosystem has gathered significant momentum owing to an increasing number of high-profile, global category-defining companies generating strong investment returns. This has driven significant liquidity, which is attracting an increasing pool of talented entrepreneurs and venture capital firms.

It has taken the best part of 20 years for Europe’s tech ecosystem to develop to the point it is at today. Adams Street believes that the components for success exist within the European ecosystem and that the European venture capital landscape offers attractive attributes for institutional investors like Adams Street.

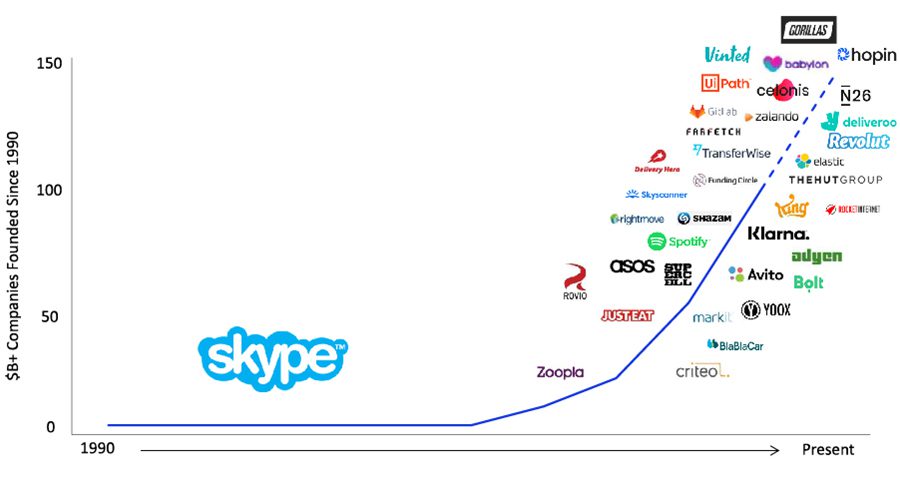

The pace at which Europe is producing unicorns1 has accelerated significantly. There are now over 220 companies valued at >$1 billion that have been founded in Europe,2 including well-known companies such as Spotify (founded in Sweden) and Adyen (founded in the Netherlands).3 In 2020, 18 European companies reached the billion-dollar valuation mark. This is particularly significant when you consider that by 2010 Europe had created just 22 unicorns in total.4

Adams Street is seeing an increasing number of global tech winners coming from Europe, as well as an increase in the velocity with which startups scale. Hopin was the fastest European company ever5 to reach unicorn status when it hit a $2.1 billion valuation in 2020, just 17 months after being founded and more recently raised further financing at a ~$7.8 billion valuation.6

Venture-backed global leaders such as Spotify, UiPath, Adyen and Revolut3 are evidence of the vibrancy of Europe’s ecosystem. We believe that these companies helped validate the thesis for investing in Europe and signalled to investors that Europe has the potential to produce both significant winners and returns. European venture has come a long way in the last 20 years and Adams Street is optimistic about the investment opportunities that are being created.

Prior to 2005, a lack of funding and the absence of a well-developed venture capital community was a structural impediment to success. Since then, venture capital investment in Europe has steadily risen, both in absolute terms and as a percentage of total global venture capital. Europe’s share of global venture investment has almost doubled in the last five years and now accounts for over 18%. In 2020, European startups raised over $46 billion in funding. This is more than double the $19 billion of total capital raised in 2016 and over 10x the $4 billion raised in 2010.7 Capital availability has increased at every investment stage, including early stage, growth stage and pre-IPO.8 This capital has been crucial in helping European companies scale to unprecedented size.9

Europe’s share of global venture investment has almost doubled in the last five years and now accounts for over 18%.

According to recent figures, European startups raised ~$56 billion in funding in the first half of 2021. This is ~$10 billion more than was raised in all of 2020. At this rate, Europe is forecast to raise ~$112 billion in VC funding in 2021, which would be an increase of over 140% year-on-year. Europe is now recognized as a major contributor to the growth of the global venture ecosystem, with North America (forecasting growth of 98%) and Asia (forecasting growth of 47%) also exhibiting strong year-on-year increases.10

The presence of world class venture firms and the permanence of capital at all investment stages is a distinguishing factor from the European ecosystem of two decades ago. Whilst capital is an integral part of ecosystem success, top venture managers also bring the know-how, experience, contacts, and operating support that helps founders scale with more velocity and avoid common pitfalls.

International appetite for European startups is also accelerating as investors recognize the rising strength of the venture ecosystem. Adams Street has seen several leading U.S. firms – Sequoia, General Catalyst, Bessemer and Battery and others – expand into Europe to strengthen their access to opportunities. That expansion signals confidence that Europe’s arrival on the global tech scene is a secular shift.

We think the increasing investor interest in European venture is driven by companies staying private for longer, which generally results in shifting value from the public to private markets. Recent figures suggest that ~60% of total estimated EV of all European technology companies is owned by private markets investors, including venture capital and private equity investors, founders, management and employees.12 Adams Street expects this trend to continue.

Venture firms have proven themselves adept at accessing Europe’s leading tech companies. By 2020, ~87% of all new European unicorns were venture-backed, up from only 20% in 2010.13 Venture firms reap the benefits through their participation in early stage financings at comparatively attractive valuations and appear well-positioned as European tech companies experience nearly unprecedented growth.14

The European ecosystem has come of age and is, in our opinion, in its strongest ever position. Adams Street has witnessed the emergence of a wave of successful tech companies – Wise, Klarna, Elastic amongst many others. We believe breakout companies like these have instilled a sense of belief and determination, cultivating a hyper-growth mindset within the region.

Europe is host to world class technical institutions and has a large supply of high caliber tech talent,15 motivated by the success and purpose that tech entrepreneurship can offer. We believe that Europe’s venture community is healthier than ever, with sophisticated and well-capitalized firms ready to finance and support the next generation of entrepreneurs seeking to build global companies and help drive attractive investment performance.

Notes

1. Companies valued in excess of $1 billion

2. Since 1990

3. Represent companies currently or previously affiliated with Adams Street Partners, either directly or indirectly, are examples of well-known European unicorns and are included for illustrative purposes only. A complete list of Adams Street Partners investments is available upon request.

4. Dealroom.co accessed March 2021.

5. uktech.news accessed September 2021

6. CNBC.com accessed September 2021

7. Dealroom.co accessed July 2021

8. Pitchbook, accessed 21 June 2021. Data includes fundraising by European and Israeli technology companies

9. The State of European Tech 2020

10. European tech ecosystem grows faster than US or Asia amid VC boom (Sifted, 30 June 2021)

11. Information regarding acceleration of number of unicorn companies in Europe from Dealroom.co accessed July 2021; Adams Street has modified this graphic by including a logos of companies we believe to be representative of this growth, including companies that Adams Street has invested in (either directly or indirectly), as well as companies unaffiliated with Adams Street. Companies listed are for illustrative purposes only and a complete list of Adams Street investments is available upon request.

12. EV = Enterprise Value. The State of European Tech 2020

13. Can Europe be the most entrepreneurial continent by dealroom.co and Sifted published October 2020

14. The State of European Tech 2020

15. Times Higher Education Rankings 2020

Important Considerations: This information (the “Paper”) is provided for educational purposes only and is not investment advice or an offer or sale of any security or investment product or investment advice. Offerings are made only pursuant to a private offering memorandum containing important information. Statements in this Paper are made as of the date of this Paper unless stated otherwise, and there is no implication that the information contained herein is correct as of any time subsequent to such date. All information has been obtained from sources believed to be reliable and current, but accuracy cannot be guaranteed. References herein to specific sectors are not to be considered a recommendation or solicitation for any such sector. Past performance is not a guarantee of future results. Projections or forward-looking statements contained in the Paper are only estimates of future results or events that are based upon assumptions made at the time such projections or statements were developed or made. There can be no assurance that the results set forth in the projections or the events predicted will be attained, and actual results may be significantly different from the projections. Also, general economic factors, which are not predictable, can have a material impact on the reliability of projections or forward-looking statements.